Auto insurance coverage can be a huge benefit when your insurer performs as it should. Unfortunately, court dockets and opinions are full of instances where insurance companies refused to do what they should, either in violation of the contract they signed or in violation of the law. When you have suffered severe or catastrophic harm in a motorcycle accident, getting the full benefit of your insurance coverage can be crucial. When your insurance company isn’t performing as it should, an experienced Oregon motorcycle accident lawyer can provide invaluable aid.

Auto insurers can violate the law in several ways. Two common ones involve refusing to pay a claim that the policy required them to cover and writing a policy that violates state law. A recent motorcycle accident case from our local area is an example of the latter, and how the legal system was able to help.

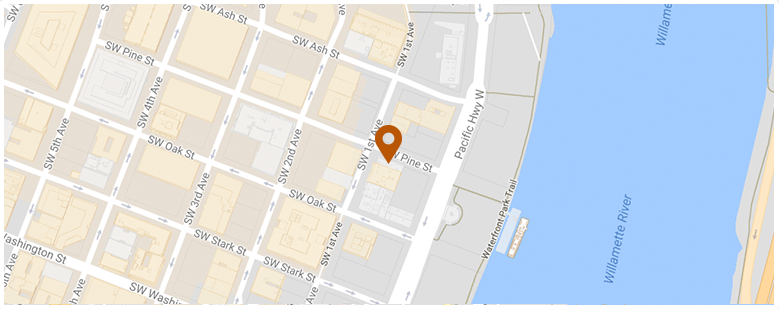

S.C. was a Portland man who had just acquired a motorcycle. Eight days after making that purchase, S.C. fell victim to a circumstance that occurs to many motorcyclists: a vehicle driver negligently making a left turn into his path. The accident left the motorcyclist with severe injuries. As is often the case in serious motorcycle accidents, the totality of the harm S.C. suffered was greater than the liability limits of the other driver’s auto insurance policy.

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog