I have said it many times before, but it bears repeating: insurance companies are businesses, not charities. Careful attention to the fine print is important.

An obvious example of this is car insurance. All drivers need to carry it, and the law lays out in great detail what that insurance has to cover and at what level. I want to focus today on Personal Injury Protection, or PIP, insurance. Unlike many states, Washington does not require drivers to carry PIP coverage, though insurance companies are required to offer it as an option. If a Washington driver opts for PIP coverage the legal minimum level is $10,000 (in Oregon, at least $15,000 in PIP coverage is a requirement).

Though many Clark County, Washington drivers may be tempted to waive it, PIP coverage can offer essential financial help in the event of an accident. Washington law requires PIP claims to be paid within a few weeks of being filed. As an analysis by BikePortland explains “few are aware that after a collision an injured person’s automobile insurance pays medical bills first – before health insurance and before the at-fault driver’s auto insurance. The injured party’s own Personal Injury Protection coverage pays these bills.”

Importantly, Washington drivers enjoy a PIP benefit denied to many other Americans (laid out in detail in RCW 48.22.085). Just over one year ago the Washington Supreme Court unanimously struck down insurers’ use of “maximum medical improvement” as a standard for judging PIP claims. Many insurance companies slip MMI into the fine print of policies in place of the more traditional coverage standard of known “reasonable, necessary or related” care. As interpreted by the insurance industry, MMI would allow claims to stop being paid once the basic treatment of an injury has finished. Insurance companies frequently use the MMI standard to refuse claims for on-going care that may be required years after a covered accident.

That case, Durant v State Farm (click here for a summary), focused on the insurer’s practice of sending vaguely-worded form letters to doctors and then using equally vague responses as an excuse for cutting off PIP claims. To its credit, the Washington Insurance Commissioner’s office supported the plaintiffs, belying State Farm’s contention that its approach to PIP payments had been approved by state regulators. The case also spawned a federal class action lawsuit focused on PIP claims. State Farm settled that suit for $18.5 million late last year.

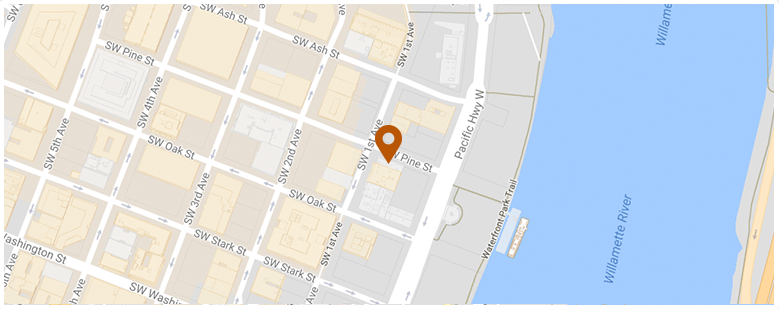

As a Portland attorney also practicing in Clark County and the rest of southwest Washington I believe it is important for drivers to be aware of these important new consumer protections. Waiving PIP coverage may seem like an easy way to save a few dollars on your car insurance (PIP is usually a relatively small part of the overall auto insurance package), but with the extra protections Washingtonians now enjoy it can offer essential help with medical bills, lost income or other expenses in the wake of a car accident, regardless of whether the claimant was the driver, a passenger, a cyclist or pedestrian.

Topclassactions.com: Summary of Durant v State Farm (Federal)

Justia.com: Durant v State Farm (State)

BikePortland on Oregon’s 2015 PIP law changes

Office of the Insurance Commissioner – Washington State: Auto Insurance

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog