A recent article in the Los Angeles Times (see link below) details the struggles that many people in northern California have faced in the wake of devastating fires that swept through the area late last year. Thousands of homes were destroyed in counties across the state. As the newspaper reports, 44 people died. Sadly, in the wake of this tragedy has come the inevitable reminder: in the words of the LA Times headline ‘your insurance company is not your friend.’

I wrote about this issue six months ago after hurricanes hit Florida and Texas. In the wake of the California wildfires the core issues are similar: an industry that will use the fine print to its advantage whenever possible, blithely ignore rules and regulations and do everything it can to do as little as possible for its customers, all while assuring them that it is there to ‘help’.

According to the LA Times the specific issue in California has been an influx of “adjusters who poured in from other states to help companies process claims” and who then “misinformed policyholders about their rights.” The paper reports that many of the out-of-state adjusters came from the South and were clearly unfamiliar with California law, which provides far stronger consumer protections than are in effect in many other parts of the country. Many of the out-of-state adjusters also appear not to have been properly registered to work in California, the paper reports. In the wake of lawsuits filed by victims, the paper quotes a spokesperson for the California Department of Insurance saying that “the agency is already investigating whether unregistered and unsupervised adjusters worked the Northern California fires.”

It is obvious that at a time of crisis insurance companies, just like first responders, should be able to move additional assets into a disaster zone. None of us would want to read stories of claims delayed for months because victims were unable even to schedule an appointment with an adjuster. But a crisis does not exempt insurance companies from their obligation to follow the law. Indeed, since insurance is largely regulated at the state, rather than federal, level, crises like the California fires place an extra burden on insurance companies to ensure that the people they send out to represent them at these moments of maximum stress are properly registered to work in the state to which they have been sent and are fully versed on its insurance rules and relevant consumer protections.

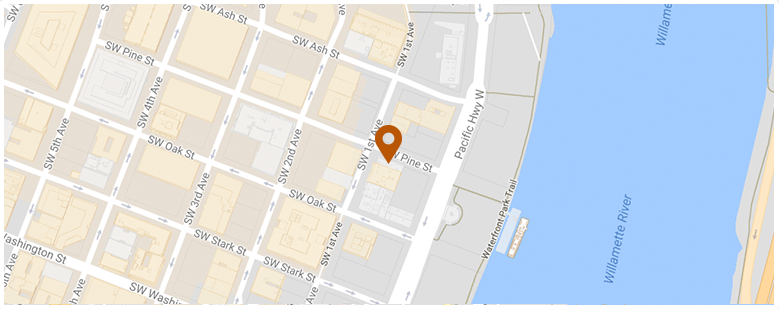

As a Portland lawyer practicing in both Oregon and Washington one of the most important elements of my work is helping people recovering from a tragedy fight large companies that see them only in terms of profit and loss. We all need insurance – for our health, our homes, our cars, and the well-being of our loved-ones. But we also need to know that the security our insurance offers will be there when we actually need it. It is good to know that when the industry fails us, its customers, our legal system offers powerful tools to hold it to account.

Los Angeles Times: Northern California wildfire victims learn ‘your insurance company is not your friend’

Adjusters International: Denied! Six Common Reasons for Denial of a Property Damage Claim

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog