People throughout the Southeast are struggling to put their lives back together after the damage caused by hurricanes Harvey and Irma over the last few weeks. More trouble, however, is on the way. Most immediately this takes the form of Hurricane Maria. This latest storm is already hitting a number of Caribbean islands hard (some of which were also hit by the earlier storms) and may also strike the US mainland in the coming days.

Some of the trouble, however, will be completely man-made. Over the coming weeks and months many homeowners struggling to rebuild are likely to discover that the policies they counted on are written more with a mind to protecting insurers than helping the insured.

Most media attention concerning hurricanes and insurance focuses on flood insurance. Few private companies are willing to underwrite flood insurance for anyone living in a flood-prone area so it is offered by the federal government instead. At times like these we see many newspaper and television stories about people who should have bought flood insurance but didn’t or, in the wake of massive storms like Harvey and Irma, people who didn’t think they needed flood insurance in the first place and are now discovering that their policies do not cover the damage to their property.

Less well-publicized is the widespread use of policy loopholes by insurance companies seeking to minimize their payouts. Many of these turn on an obscure insurance doctrine known as “concurrent causation.” This states that if your insured property is destroyed by two things at the same time – such as wind and flooding – but you are only covered for one of those causes then the policy must still pay out.

This is a well-established doctrine that has been reaffirmed by both state and federal courts over the decades. In recent years, however, the insurance industry has increasingly sought a way around it by inserting ‘anti-concurrent causation’ clauses into the fine print of policies. A recent article in Forbes quoted a representative of the Consumer Federation of America warning that “insurers have been steadily increasing hurricane wind coverage deductibles and setting new limits” on how much policies will pay. “Disclosures,” he added, “are often buried in renewal paperwork that consumers may not understand or even read.” The magazine goes on to warn that “insurers may try to wiggle out of covering homes with both wind and water damage” using anti-concurrent causation “clauses that remove coverage for wind damage if an ‘uninsured flood’ occurs at the same time.”

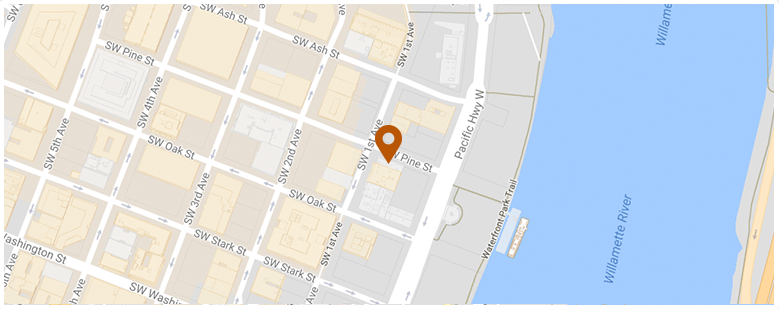

As an attorney practicing in Oregon and Washington it is worth adding that for us here in the Pacific Northwest this is far from an academic discussion. While we obviously do not suffer from hurricanes in our part of the country even a cursory glance at some of the links below should give many Northwest homeowners pause. People losing their property to a landslide in a forest or coastal area often face very similar issues to those coping with the aftermath of a hurricane since many policies cover storm damage but specifically exclude landslides.

It is worth adding that this is one of those issues where the place you live can have a huge impact on how many protections you enjoy. An analysis by the reinsurance company GenRe noted that Washington is one of a handful of states where courts have refused to honor anti-concurrent causation clauses in homeowners’ policies. The same paper (see link below) listed Oregon as one of more than two-dozen states where courts have not definitively ruled on the issue.

At a moment when insurance companies are already airing commercials congratulating themselves on their caring and helpful attitude it is worth remembering that what the marketing department says is often a far cry from what the adjusters are willing to authorize. In the wake of Hurricane, Katrina Louisiana’s courts spent years considering the cases of homeowners who justifiably felt cheated by their insurance companies (GenRe lists Louisiana among the 18 states where courts have taken the insurance companies’ side in litigation surrounding anti-concurrent causation clauses). Much the same thing happened five years ago in New York and New Jersey in the aftermath of Superstorm Sandy. Sadly, the years to come promise more of the same for people throughout the Southeast.

Forbes: Are Hurricane Irma Victims Getting a Fair Shake from Insurers?

USA Today: After Hurricanes Harvey, Irma: Tips for filing an insurance claim

Adjusters International: Denied! 6 Common Reasons for Denial of a Property Damage Claim

GenRe.com: Anti-Concurrent Causation Clauses in Property Policies

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog