This summer saw some of the largest and most dangerous wildfires ever recorded here in the West. The fall has brought two of the most destructive hurricanes in modern US history to South Carolina and Florida. So, it is with a kind of grim resignation that I return to the subject of insurance companies.

As I have written in the past – most recently in this post from last February – it is essential to look past the insurance industry’s warm and soothing slogans about how they’re always there when you need them. Insurance companies are businesses and their profitability is inversely related to the number and size of the claims they actually pay. That shouldn’t need to be said but, sadly, it does.

This goes well beyond a simple case of ‘always read the fine print.’ Insurance policies are contracts like any other. But it is one thing for a company to inform a policyholder that they are not covered for something and quite another thing for companies to actively seek ways to get out of paying claims that any reasonable policyholder should expect to be paid.

The tricks the industry uses to get out of paying claims in disaster zones are well documented (see the links below). What receives less attention is the everyday effort the industry puts into preserving its profit levels at the expense of its customers. Last year USAA, a company that heavily promotes its patriotism and ties to the US military, “agreed to pay $39 million to settle a class-action lawsuit in Florida… (which) challenged the way the insurance company reimbursed customers for vehicle insurance claims of totaled cars and trucks,” according to an article last year in the San Antonio Business Journal. The company has also been dogged for years by accusations that it regularly hires outside auditors as part of cost-containment schemes to limit the size of personal injury protection, or PIP, claims made under its auto policies. One Oregon lawsuit addressing this topic was filed as far back as 2011, according to MySanAntonio.com (USAA’s headquarters are located in San Antonio, Texas). It accused USAA of using what were essentially medical form letters to deny PIP claims. Accusations like these are especially galling because, as a Palm Beach Post article published last winter notes, insurance companies have strongly supported laws making PIP a mandatory element of car insurance coverage.

It is important for Oregonians to understand that our state’s laws offer explicit protection against this sort of behavior. A case decided a decade ago, Ivanov v Farmers Ins Co, established that, in the context of PIP insurance claims, medical and treatment bills are presumed to be reasonable. If the insurance company believes that the claims are inflated, unreasonable or fraudulent it is they who must prove this, and cannot simply deny payment for things that would otherwise fall within the policyholder’s coverage.

ORS 742.524 lays out the scope of PIP policies here in Oregon. Policies are required to cover “all reasonable and necessary expenses of medical, hospital, dental, surgical ambulance and prosthetic services incurred within two years of the date of a person’s injury.” The law also caps such expenses at $15,000, but this does not prevent a severely injured person from filing other claims against, for example, a reckless, negligent or distracted driver.

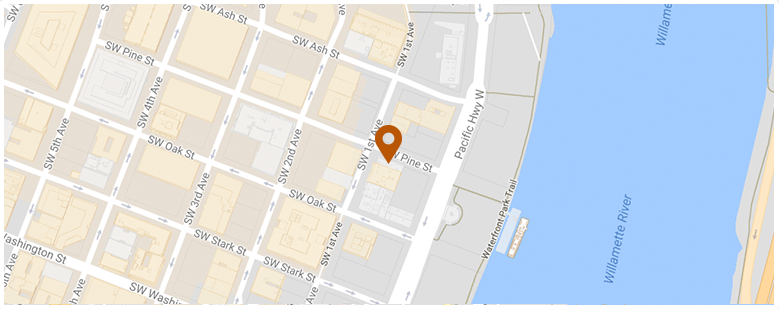

As a Portland lawyer practicing in both Oregon and Washington one of my jobs is to help ordinary Oregonians and Washingtonians navigate the maze of fine print and confusing language on which this system depends. All of us deserve to be treated seriously and respectfully by the companies from which we have purchased insurance, particularly when we come to them for help at times of great trauma or stress. The fact that insurance fraud exists should not be a license for any company to treat its own customers like criminals. Sadly, this happens all too often. An important part of my job is making sure that people have a professional advocate who speaks the language of the insurance companies, giving them a chance to get the justice they deserve.

Oregon Supreme Court via Justia: Ivanov v Farmers Ins Co (2008)

Adjusters International: Denied! Six Common Reasons for Denial of a Property Damage Claim

Claims Journal: Contractors Prey on Hurricane, Wildfire Victims After Disasters

WSOC-TV: After Florence, what to know about your insurance claims

San Antonio Business Journal: USAA settles auto insurance class action lawsuit for $39m in Florida

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog