A report broadcast last Sunday on 60 Minutes brought into stark detail alleged abuses in the insurance industry. CBS News found a pattern, which it believes is replicated nationwide, of insurance giants failing to pay life insurance policies despite knowing that the insured person had died.

The report quotes Florida’s insurance commissioner calling the behavior “unconscionable, indefensible” and alleging that it is close to universal in the industry. Simply put, it involves insurance companies knowing that a person has died but failing to inform the beneficiaries of life insurance policies. Instead, the company simply waits for premium payments from the now-deceased policyholder to stop coming in, then cancels the policy for non-payment and pockets what would have been the benefit owed to a surviving spouse, children or grandchildren.

CBS adds: “In a little-known series of settlements, 25 of the nation’s biggest life insurance companies have agreed to pay more than $7.5 billion in back-death benefits. However, about 35 insurance companies have not settled and remain under investigation for not paying when the beneficiary is unaware there was a policy, something that is not at all uncommon.”

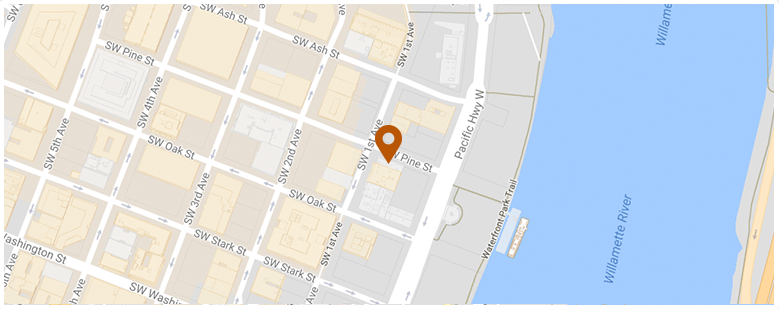

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog