In banking and insurance – businesses that people need but often hate – few companies have as stellar a reputation as the United Services Automobile Association, commonly known by its initials: USAA. The company is a membership organization, functioning in much the same way as a credit union. Many of the services it provides are offered at a lower cost than comparable commercial competitors, with membership open only to people who have served in the military and their extended families.

Because its core market consists of active duty military, veterans and their families the organization is often surrounded by a kind of patriotic halo. Yet USAA, like any other company, is ultimately in business to make money. Perhaps it is not surprising, then, that USAA has spent years fighting lawsuits that claim it frequently puts profits ahead of people in one of its core businesses: insurance.

According to the company’s Hometown newspaper, the San Antonio News-Express, “USAA continues to be dogged by lawsuits that allege it uses a ‘cost containment scheme’ to delay, deny or reduce medical payouts to customers injured in auto accidents.”

As a 2015 article on the website Law360 noted, the insurer has been accused of “using the ‘Medicare fee schedule method,’ which takes into account official Medicare rates to make reimbursements, instead of the traditional ‘reasonable amount method,’ which is based on the policy and considers health care providers’ usual charges in determining its MedPay payments. A MedPay policy covers the insured driver’s and passenger’s medical expenses resulting from an accident.” Since hospitals only charge the Medicare rate for Medicare patients this is a transparent attempt to use industry jargon to keep the company’s costs down and its profits up at customers’ expense.

Over the last decade the company has been sued over this approach to payments multiple times in several different states (insurance regulation is mainly a matter of state, not federal, law). While the exact claims vary from place to place a consistent thread runs through them: that USAA’s culture of cost containment is deeply at odds with the way it markets itself as an organization dedicated to giving something back to those who serve.

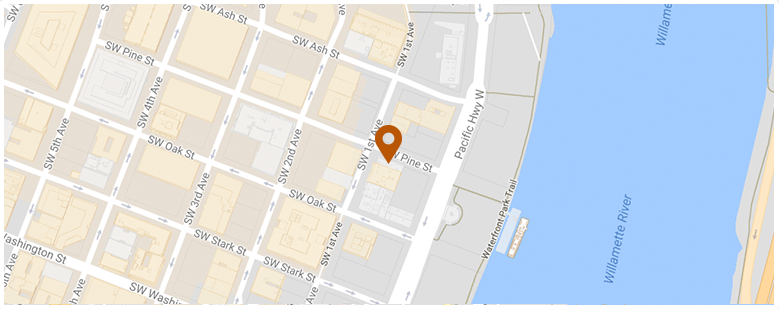

I became an attorney here in Portland because I believe it is important for everyone to have the chance to make their case in court. In that capacity I have represented many injured clients who were also USAA members. USAA often uses a company called Auto Injury Solutions to audit its members medical bills. Auto Injury Solutions regularly holds up or denies payments claiming that the treatment an injured person received was not ‘reasonable.’ These assessments are made only through an analysis of medical records – the patient herself is rarely if ever examined and doctors themselves are rarely consulted.

Simply put: USAA is counting on the fact that its size and the law’s complexity will scare most people out of suing them for breach of contract and bad faith. Often, when challenged USAA just agrees to pay the treatment bills, but it should not require the threat of legal action to get USAA or any other company to honor the commitments it has made to its customers. This is no way to treat our Vets and their families.

San Antonio News-Express: Hidalgo jury awards USAA member $1.8m over hail claim

San Antonio News-Express: ‘Med Pay’ lawsuits dog USAA

Law360: USAA skimped on MedPay Reimbursements, Class suit says

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog