The commercials talk about your being “in good hands” or that they’re “like a good neighbor” but, too many times, insurance companies are not the reliable helpers they advertise, especially if that help involves paying you everything you’re owed on a claim. When your insurance company has unreasonably and unfairly denied your claim, a knowledgeable Oregon auto accident lawyer can help you assess exactly what your options are.

Regarding those options when an insurance company acted in bad faith, a recent ruling from the Oregon Court of Appeals may have expanded them even more, opening the door to recovery of noneconomic damages.

The underlying dispute involved a man who died when his friend accidentally shot him during a camping trip. After the man’s tragic passing, his wife filed a claim with their life insurance company, Federal Insurance. The insurance company denied the wife’s claim on the $3,000 policy.

A sheriff’s toxicology report indicated that the deceased man had some marijuana in his system when he died, so the insurance company invoked a policy exclusion for “accidents caused by or resulting from the insured being under the influence,” and refused to pay, despite the lack of proof linking the deceased’s marijuana use with the shooting.

The wife retained an attorney and sued the insurance company for its failure to act in good faith. The claims she asserted included both breach of contract and negligence per se. That latter one, negligence per se, was very important because it is a “tort claim” and allows you to seek additional forms of compensation beyond what you typically can get in a contract action.

A contract lawsuit often only allows you to get the compensation needed to make you contractually whole. For example, if your insurance company wrongfully denied your $3,000 claim, then your contract damages award is the sum you were wrongfully denied — $3,000.

Opening the Door to a Damages Award for Emotional Distress

A tort claim allows you to seek damages for other things called “noneconomic damages,” which include harms like emotional distress. In this life insurance case, the wife sought $3,000 for the insurer’s breach of contract and an additional $47,001 for emotional distress caused by the wrongful denial of the claim.

The appeals court said that she could pursue both claims. Oregon has a statute that governs what are “unfair claim settlement practices,” and the wife sufficiently alleged violations of both Subsection (d), which requires insurers to do a “reasonable investigation” and Subsection (f), which requires insurers to attempt, “in good faith, to promptly and equitably settle claims in which liability has become reasonably clear.”

This case involved life insurance, but the appeals court’s ruling isn’t specific to life insurance claims. The Unfair Claim Settlement Practices statute applies to all insurers, which means that the obligation to complete a reasonable investigation and to settle claims swiftly and equitably once the insurer’s liability is clear applies to auto insurers just as much as life insurance companies.

So, how may this affect you? Let’s say that you were seriously injured in an accident where the driver who hit you was both 100% at fault and uninsured. Despite these facts, your insurance company invents phony reasoning and refuses to pay your uninsured/underinsured (UM/UIM) coverage claim.

Certainly, that failure to pay could cause you great harm. The absence of that money may make you terrified about how you’ll pay your bills… maybe even how you’ll pay for your most basic necessities. Under this ruling, not only can you potentially recover the funds the insurance company wrongfully didn’t pay, but also an award for the emotional toll that wrongful denial took upon you.

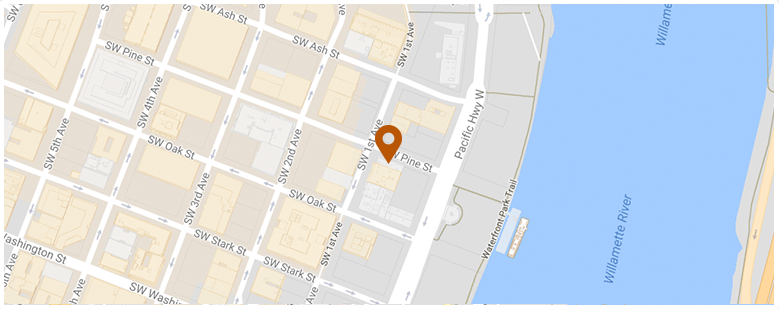

Warm, fuzzy, and soothing commercials notwithstanding, the reality is that insurance companies too often work to avoid paying you what they should. When you’re injured in an auto accident, having to battle with one or more auto insurers is a distinct possibility, so make sure you’re ready by having knowledgeable legal representation. The experienced Oregon auto accident attorneys at Kaplan Law LLC are dedicated to providing clients with representation that is personal, skillful, and powerful. Call us today at (503) 226-3844 or contact us online to set up your free consultation.

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog