I first wrote about the barriers that arbitration clauses place in the way of Oregonians seeking justice nearly three years ago. Today, I am returning to the subject because it is important that readers in Oregon and Washington understand what the Congress has just done, how it effects their rights and what they may be able to do about it.

Last week the Senate joined the House in voting to reverse a rule issued last July by the Consumer Financial Protection Bureau (CFPB). As described by the Reuters news agency the vote “killed a rule banning (financial) firms from using ‘forced arbitration’ clauses.”

As the news agency goes on to explain: “customers must agree to the clauses as a condition of opening accounts, saying they will take any disputes to closed-door arbitration instead of joining class-action lawsuits, where complainants band together to share litigation costs. The clauses are used for nearly every US consumer product and service since the Supreme Court ruled them legal in 2011.”

The financial industry has argued that arbitration clauses help keep down the cost of credit for consumers, but the fact is that they do so only in the sense because they make it far easier for banks and credit card companies to cheat their customers. If fake charges are added to your account and your local bank manager proves unresponsive, suing over a small sum makes little sense for any particular individual. Class actions exist precisely to help our justice system hold large companies accountable for dangerous or predatory behavior. This is especially so when the damage to individual customers is relatively small, but the collective profits – and therefore the incentives – for the company are huge. Eliminating the customers’ ability to sue makes such practices (like the large bank that opened millions of accounts in its customers’ names without their knowledge – something which generated profits for the bank while negatively effecting millions of people’s credit ratings), in essence, a win-win for the bad actor. As the online publication The Intercept noted, quoting Federal Circuit Judge Richard Posner, “the realistic alternative to a class action is not 17 million individual suits, but zero individual suits, as only a lunatic or a fanatic sues for $30.”

The issue was serious enough that, as reported by Reuters, CFPB Director Richard Cordray broke his usual rule about not commenting on Congressional actions. He issued a statement saying, in part: “Wall Street won and ordinary people lost… This vote means the courtroom doors will remain closed for groups of people seeking justice and relief when they are wronged by a company.”

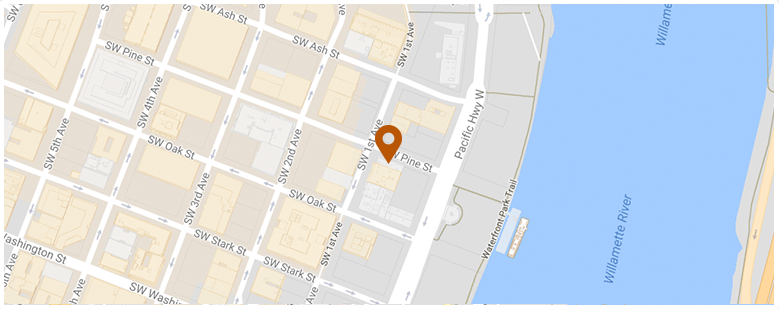

So what can ordinary Oregonians and Washingtonians do at moments like this? As a Portland attorney practicing in both states I tell clients facing situations like these that potential solutions often exist. A careful and experienced lawyer looking at the totality of a company’s conduct – including the ways that third parties, such as sub-contractors, may be involved in any legal malfeasance – can often find areas where a bad actor may still be subject to the rule of the courts rather than a closed-door arbitration panel. It is important to understand that companies may use the fine print to make it difficult for individuals to sue them, but this does not exempt them from many other laws and regulations imposed by all levels of government.

Defective products, reckless or negligent corporate conduct and the flouting of health and safety rules are ultimately matters for our courts and not for private arbitrators (who are often paid by the companies themselves – a fact which by itself ought to call into question their impartiality). Oregonians and Washingtonians should do all they can to defend their right to seek justice in a court of law, rather than in a one-sided arbitration panel. As long as Congress continues to take the side of big banks and other companies, however, it is important to know that skilled attorneys can still help anyone needing to navigate their way through the legal system to get their day in court.

The Intercept: After day of feuding, Jeff Flake and Bob Corker join Trump to upend a major consumer protection

Reuters via The New York Times: Republicans, Wall Street Score Victory in Dismantling Class-Action rule

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog