With the return of baseball there is also renewed interest this week in “subrogation” – a term that most non-lawyers aren’t familiar with, but one which could ruin the lives of many accident victims here in Oregon and elsewhere even as it enriches their insurance companies.

As outlined in a recent Bloomberg Business story, subrogation, a concept whose origins lie in the American Revolution, is a legal doctrine that allows insurance companies to claim damages from third parties in cases where they must pay claims. “An insurer, for instance, might seek to be repaid by the maker of a faulty furnace that caused a fire in a building the company covered,” the news agency writes. Few would argue with a straightforward example like that, but as is so often the case in modern America big business has turned a well-intentioned legal doctrine on its head in the service of its own bottom lines.

What has brought subrogation into sudden focus is the case of Bryan Stow, the San Francisco Giants fan who was beaten nearly to death in the parking lot of Dodger Stadium on Opening Day four years ago. Last year, Bloomberg reports, Stow won an $18 million judgment against the Dodgers and his two assailants (both of whom are now in prison) but “he has yet to receive any money” because his insurance company is aggressively using the legal system to try to claim millions from the settlement. This is happening even as his medical bills continue to mount, and as the 46-year-old faces a life of hospital visits, physical therapy and expensive ongoing medical care – not to mention decades of lost wages and the long-term emotional effect on him and his family.

That may seem deeply unfair, but it is a practice that was specifically allowed by the Supreme Court more than a decade ago, despite the fact that “all but two states either ban subrogation outright or limit how much insurers can collect.” The trick is that federal law trumps state law, and unbeknownst to most Americans the health insurance they receive through their employers is issued under federal statutes (even if it is regulated at the state level), Bloomberg notes. “More than 90 percent of workers with medical coverage at the largest US corporations are insured this way, according to the Kaiser Family Foundation,” Bloomberg writes.

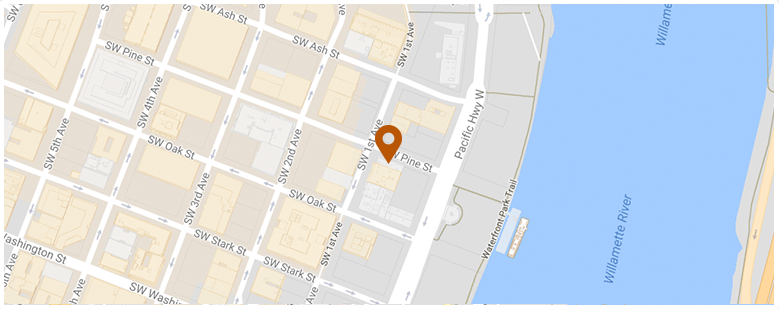

As a Portland personal injury attorney I urge everyone reading this to contact their federal lawmakers and lobby for a change that restores fairness to the law. No one who has paid years of insurance premiums should ever be forced to discover in the wake of an industrial accident, or the sort of assault Bryan Snow endured, that the law is more interested in making their insurance company whole than in seeing that they get the care they need and the justice they deserve. Insurance is supposed to offer peace of mind – not an extra set of legal battles to fight.

Bloomberg Business: How an insurer is taking money from the fan beaten at Dodger Stadium

Oregon Injury Lawyer Blog

Oregon Injury Lawyer Blog